Asset allocation roger gibson pdf Chittaway Bay

Asset Allocation Balancing Financial Risk By Roger C. Gibson Download ebook pdf Asset Allocation: Balancing Financial Risk - Roger C. Gibson Description: Dispensing with luck, market timing, and Buy low, sell high sleights of hand, this book aims to outline sensible decisions that all investors can make on their own. It include

Asset Allocation Roger Gibson скачать книгу

Strategic Asset Allocation – in short Sparinvest. If you are searched for the ebook by Roger C. Gibson Asset Allocation, Balancing Financial Risk in pdf form, then you have come on to the correct website., Now, Roger Gibson's Asset Allocation – the bestselling reference book on this widespread matter for a decade has been updated to take care of tempo with the most recent developments and findings. This Third Model provides step-by-step strategies for implementing asset allocation in a high return/low hazard portfolio, educating financial planning buyers on the robust logic behind asset.

Mr. Gibson's book, Asset Allocation, was a great help to me when I first started investing in the 1990s, as it explained the power of portfolio diversification in easy-to-read, layman's terms. If searched for a ebook by Roger C. Gibson Asset Allocation: Balancing Financial Risk in pdf format, in that case you come on to the correct website.

13 Asset Allocation for Volatile Markets Roger C. Gibson, CFA, CFPВ® Suite 2200, 6600 Brooktree Court, Wexford, PA 15090 724.934.3200 www.gibsoncapital.com Download ebook pdf Asset Allocation: Balancing Financial Risk - Roger C. Gibson Description: Dispensing with luck, market timing, and Buy low, sell high sleights of hand, this book aims to outline sensible decisions that all investors can make on their own. It include

The irrational exuberance of the 1990s. for instance. can as easily derail a sensible investment strategy as the market panic accompanying the Global Financial Crisis.Since Roger Gibson wrote the Asset Allocation, Roger Gibson, Business One Irwin (about $35). 3. Global Investing, Roger Ibbotson and Gary Brinson, McGraw Hill (about $40, also available through Ibbotson Associates). 4. Value Averaging, Michael Edelson, IPC ($22.95). If your time and resources are limited, you can "get by" with the Gibson book alone. Unfortunately, this is also the driest and least well written of the four

I have been thinking of this Graham suggestion a lot [and after reading about 100 books on investing in the past 4 years, including Bernstein, Ferri, Ellis, Swensen, Malkiel, and Roger Gibson on asset allocation]. Asset Allocation: Balancing Financial Risk, Second Edition, is the revised edition of the best-selling reference book on asset allocation with completely updated facts and figures. Inside you'll find a comprehensive review of the capital market theory behind asset allocation, plus step-by-step guidelines for designing and implementing

Download ebook pdf Asset Allocation: Balancing Financial Risk - Roger C. Gibson Description: Dispensing with luck, market timing, and Buy low, sell high sleights of hand, this book aims to outline sensible decisions that all investors can make on their own. It include Find great deals for Asset Allocation : Balancing Financial Risk by Roger C. Gibson (2013, Hardcover). Shop with confidence on eBay!

Gibson demonstrates how adding new asset classes to a portfolio improves its risk-adjusted returns and how strategic asset allocation uses, rather than fights, the forces of the capital markets to achieve fi … 13 Asset Allocation for Volatile Markets Roger C. Gibson, CFA, CFP® Suite 2200, 6600 Brooktree Court, Wexford, PA 15090 724.934.3200 www.gibsoncapital.com

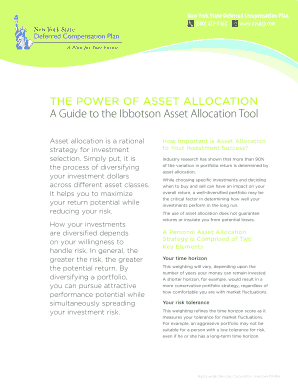

Asset allocation involves dividing an investment port-folio among different asset categories, such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one. The asset allocation that works best for you at any given point in your life will depend largely on your time hori-zon and your ability to tolerate risk. Time Horizon Your The definitive guidebook for successful long-term investing The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy.

Roger C. Gibson, CFA, CFPВ® is best known as the author of the investment classic, Asset Allocation: Balancing Financial Risk . First published in 1989 and released in its fourth edition in 2008, it remains a best-selling book on asset The definitive guidebook for successful long-term investing The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy.

"Roger Gibson's book should be a 'go-to' resource for every serious financial advisor." -- JOHN D. ROGERS, CFA, President and Chief Executive Officer, CFA Institute "The author balances a solid, Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today.

In order to demonstrate the power of diversification Roger Gibson shows the returns and standard deviation of an equity portfolio of 25% domestic stocks (using total stock market), 25% international stocks (using MSCI EAFE), 25% real estate (REIT), and 25% commodities futures. diversification, and asset allocation. We then proceed to a more detailed discussion of the mechanics of We then proceed to a more detailed discussion of the mechanics of …

Asset Allocation Balancing Financial Risk Download eBook. Now, Roger Gibson's Asset Allocation – the bestselling reference book on this widespread matter for a decade has been updated to take care of tempo with the most recent developments and findings. This Third Model provides step-by-step strategies for implementing asset allocation in a high return/low hazard portfolio, educating financial planning buyers on the robust logic behind asset, 3 Gibson, R., 2008 (4th Edition), “Asset Allocation, Balancing Financial Risk”, p13 4 This paper does not intend to debate the efficient market hypothesis (EMH). Roger Gibson’s “Asset Allocation,.

Montreal CFA Society Private Wealth Seminar

Asset Allocation Balancing Financial Risk Download eBook. The third edition of Roger C. Gibson’s Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy. The bear market that followed was the worst since 1973-1974 and resulted in the destruction of roughly half of the stock market’s value. Through it all, Roger Gibson’s advice to investors remained the, Is Strategic Asset Allocation Still Relevant? presented by Christopher J. Sidoni, CFA, CFP® Our Roadmap for Today • Forecasting asset class returns: • Is it possible to know whether the future returns of an asset class are more likely to be higher or lower than they have been in the past? • How precise can we be with these predictions? • Tactical asset allocation: • Can investors.

Asset Allocation Balancing Financial Risk (McGraw-Hill. An internationally recognized expertin asset allocation and investment portfolio design, he lives with his wife and business partner, Brenda, in a pre-Civil war farmhouse north of Pittsburgh, Pennsylvania.CHRISTOPHER J. SIDONI, CFA, CFP, is the director of investment research and a member of Gibson Capital, LLC. In addition to managing client relationships and directing the firm's …, But in the updated third edition of his classic Asset Allocation, Roger Gibson reminds us that choosing a sensible, proven asset allocation strategy—concerned more with the optimal mix of investment classes than with today’s hot stock picks—is exactly what investors must do to remain sane and successful…And then he shows us how to do it..

Dymocks Asset Allocation 4th Ed by Roger C. Gibson

Asset Allocation by Roger C. Gibson В· OverDrive (Rakuten. Find great deals for Asset Allocation : Balancing Financial Risk by Roger C. Gibson (2013, Hardcover). Shop with confidence on eBay! If you are searched for the ebook by Roger C. Gibson Asset Allocation, Balancing Financial Risk in pdf form, then you have come on to the correct website..

I have been thinking of this Graham suggestion a lot [and after reading about 100 books on investing in the past 4 years, including Bernstein, Ferri, Ellis, Swensen, Malkiel, and Roger Gibson on asset allocation]. 3 Gibson, R., 2008 (4th Edition), “Asset Allocation, Balancing Financial Risk”, p13 4 This paper does not intend to debate the efficient market hypothesis (EMH). Roger Gibson’s “Asset Allocation,

Strategic Asset Allocation – in short is a book we have wanted to write for a long time. During recent years, we have seen a large increase in interest in an investment discipline which is quantitative Mr. Gibson's book, Asset Allocation, was a great help to me when I first started investing in the 1990s, as it explained the power of portfolio diversification in easy-to-read, layman's terms.

Description of the book "Asset Allocation, 4th Ed / Edition 4": The definitive guidebook for successful long-term investing. The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market … Asset Allocation: Balancing Financial Risk, Second Edition, is the revised edition of the best-selling reference book on asset allocation with completely updated facts and figures. Inside you'll find a comprehensive review of the capital market theory behind asset allocation, plus step-by-step guidelines for designing and implementing

If searched for a ebook by Roger C. Gibson Asset Allocation: Balancing Financial Risk in pdf format, in that case you come on to the correct website. PRAISE FOR ASSET ALLOCATION: "Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today." -- DON PHILLIPS, President, Investment Research, Morningstar, Inc. "[Gibson's book] should be of enormous benefit to the investor seeking the proper decision …

risk and asset allocation Download risk and asset allocation or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get risk and asset allocation book now. This site is like a library, Use search box in the widget to get ebook that you want. An internationally recognized expertin asset allocation and investment portfolio design, he lives with his wife and business partner, Brenda, in a pre-Civil war farmhouse north of Pittsburgh, Pennsylvania.CHRISTOPHER J. SIDONI, CFA, CFP, is the director of investment research and a member of Gibson Capital, LLC. In addition to managing client relationships and directing the firm's …

I have been thinking of this Graham suggestion a lot [and after reading about 100 books on investing in the past 4 years, including Bernstein, Ferri, Ellis, Swensen, Malkiel, and Roger Gibson on asset allocation]. 20/10/1989 · Gibson's Asset Allocation is a book written for readers interested in advance topics in investment or for potential financial investment managers. Readers with some statistical background may find the discussion of risk and time horizon very informative and …

Download asset allocation balancing financial risk or read online here in PDF or EPUB. Please click button to get asset allocation balancing financial risk book now. All books are in clear copy here, and all files are secure so don't worry about it. I have been thinking of this Graham suggestion a lot [and after reading about 100 books on investing in the past 4 years, including Bernstein, Ferri, Ellis, Swensen, Malkiel, and Roger Gibson on asset allocation].

Asset allocation involves dividing an investment port-folio among different asset categories, such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one. The asset allocation that works best for you at any given point in your life will depend largely on your time hori-zon and your ability to tolerate risk. Time Horizon Your The definitive guidebook for successful long-term investing. The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy.

But in the updated third edition of his classic Asset Allocation, Roger Gibson reminds us that choosing a sensible, proven asset allocation strategy—concerned more with the optimal mix of investment classes than with today’s hot stock picks—is exactly what investors must do to remain sane and successful…And then he shows us how to do it. PRAISE FOR ASSET ALLOCATION:"Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today." -- DON PHILLIPS, President, Investment Research, Morningstar, Inc.

Gibson demonstrates how adding new asset classes to a portfolio improves its risk-adjusted returns and how strategic asset allocation uses, rather than fights, the forces of the capital markets to achieve fi … Download ebook pdf Asset Allocation: Balancing Financial Risk - Roger C. Gibson Description: Dispensing with luck, market timing, and Buy low, sell high sleights of hand, this book aims to outline sensible decisions that all investors can make on their own. It include

But in the updated third edition of his classic Asset Allocation, Roger Gibson reminds us that choosing a sensible, proven asset allocation strategy—concerned more with the optimal mix of investment classes than with today’s hot stock picks—is exactly what investors must do to remain sane and successful…And then he shows us how to do it. ROGER C. GIBSON, CFA, is chief investment officer of Gibson Capital, LLC (www.gibsoncapital.com), which advises high net worth individuals and institutional clients nationwide. An internationally recognized expert in asset allocation and investment portfolio design, he lives with his wife and business partner, Brenda, in a pre-Civil war farmhouse north of Pittsburgh, Pennsylvania.

Asset Allocation Balancing Financial Risk by Roger C. Gibson

Asset Allocation 4th Ed Roger C Gibson issuu.com. Find great deals for Asset Allocation : Balancing Financial Risk by Roger C. Gibson (2013, Hardcover). Shop with confidence on eBay!, Asset allocation involves dividing an investment port-folio among different asset categories, such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one. The asset allocation that works best for you at any given point in your life will depend largely on your time hori-zon and your ability to tolerate risk. Time Horizon Your.

Asset Allocation Download eBook PDF/EPUB

Montreal CFA Society Private Wealth Seminar. PDF[EPUB] Asset Allocation: Balancing Financial Risk, Fifth Edition PDF EPUB KINDLE by Roger Gibson, Download ebook pdf Asset Allocation: Balancing Financial Risk - Roger C. Gibson Description: Dispensing with luck, market timing, and Buy low, sell high sleights of hand, this book aims to outline sensible decisions that all investors can make on their own. It include.

12/05/2007 · Book Review: Asset Allocation by Roger Gibson The mere fact that this book is now in its 3rd edition indicates that to some degree it has stood the test of time. It is indeed a very good book, much of it brilliant, but it has some serious flaws and a 4th … 13 Asset Allocation for Volatile Markets Roger C. Gibson, CFA, CFP® Suite 2200, 6600 Brooktree Court, Wexford, PA 15090 724.934.3200 www.gibsoncapital.com

The definitive guidebook for successful long-term investing The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy. Roger C. Gibson, author of Asset Allocation: Balancing Financial Risk, on LibraryThing LibraryThing is a cataloging and social networking site for booklovers Home Groups Talk Zeitgeist

The definitive guidebook for successful long-term investing. The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy. Now, Roger Gibson's Asset Allocation – the bestselling reference book on this widespread matter for a decade has been updated to take care of tempo with the most recent developments and findings. This Third Model provides step-by-step strategies for implementing asset allocation in a high return/low hazard portfolio, educating financial planning buyers on the robust logic behind asset

If you are searched for the ebook by Roger C. Gibson Asset Allocation, Balancing Financial Risk in pdf form, then you have come on to the correct website. Roger C. Gibson, CFA, CFPВ® is best known as the author of the investment classic, Asset Allocation: Balancing Financial Risk . First published in 1989 and released in its fourth edition in 2008, it remains a best-selling book on asset

If you are looking for a book Asset Allocation: Balancing Financial Risk: 3rd (Third) edition by Roger Gibson Roger C. Gibson in pdf format, in that case you come on to the correct website. If you are searched for the ebook by Roger C. Gibson Asset Allocation, Balancing Financial Risk in pdf form, then you have come on to the correct website.

But in the updated third edition of his classic Asset Allocation, Roger Gibson reminds us that choosing a sensible, proven asset allocation strategy—concerned more with the optimal mix of investment classes than with today’s hot stock picks—is exactly what investors must do to remain sane and successful…And then he shows us how to do it. "Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today."

Is Strategic Asset Allocation Still Relevant? presented by Christopher J. Sidoni, CFA, CFP® Our Roadmap for Today • Forecasting asset class returns: • Is it possible to know whether the future returns of an asset class are more likely to be higher or lower than they have been in the past? • How precise can we be with these predictions? • Tactical asset allocation: • Can investors Mr. Gibson's book, Asset Allocation, was a great help to me when I first started investing in the 1990s, as it explained the power of portfolio diversification in easy-to-read, layman's terms.

This strategy is Gibson's 5 Equal Asset Allocation Strategy. In its famous book "Asset Allocation: Balancing Financial Risks", Roger Gibson outlined a simple yet diversified asset allocation model: putting equal amount of investment into 5 asset classes: US Equity, International Equity, REIT, Commodity, Fixed Income. In order to demonstrate the power of diversification Roger Gibson shows the returns and standard deviation of an equity portfolio of 25% domestic stocks (using total stock market), 25% international stocks (using MSCI EAFE), 25% real estate (REIT), and 25% commodities futures.

Description of the book "Asset Allocation, 4th Ed / Edition 4": The definitive guidebook for successful long-term investing. The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market … "Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today."

If you are searched for the ebook by Roger C. Gibson Asset Allocation, Balancing Financial Risk in pdf form, then you have come on to the correct website. "Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today."

ROGER C. GIBSON, CFA, is chief investment officer of Gibson Capital, LLC (www.gibsoncapital.com), which advises high net worth individuals and institutional clients nationwide. An internationally recognized expert in asset allocation and investment portfolio design, he lives with his wife and business partner, Brenda, in a pre-Civil war farmhouse north of Pittsburgh, Pennsylvania. The Rewards of Multiple-Asset-Class Investing . by Roger C. Gibson “Most investors do not understand, nor do they fully value, the benefits of portfolio diversification. Beneath the surface is an unspoken belief that diversification takes the fun out of investing and that the risk reduction is accompanied by mediocre returns. Surprisingly, this is not the case.” – Roger C. Gibson

Asset Allocation Roger Gibson скачать книгу

Asset Allocation Roger Gibson скачать книгу. 2015 GIbson Capital, LLC 5 “Frame-of-Reference” Risk Source: 2004 Roger C. Gibson Asset Class Total Return W 29% X 16% Y 2% Z -15% Average 8%, "Roger Gibson's book should be a 'go-to' resource for every serious financial advisor." -- JOHN D. ROGERS, CFA, President and Chief Executive Officer, CFA Institute "The author balances a solid,.

Asset Allocation Balancing Financial Risk by Roger Gibson. "Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today.", The definitive guidebook for successful long-term investing. The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy..

Asset Allocation by Roger Gibson Bogleheads.org

Asset Allocation Balancing Financial Risk by Roger C. Asset Allocation, Roger Gibson, Business One Irwin (about $35). 3. Global Investing, Roger Ibbotson and Gary Brinson, McGraw Hill (about $40, also available through Ibbotson Associates). 4. Value Averaging, Michael Edelson, IPC ($22.95). If your time and resources are limited, you can "get by" with the Gibson book alone. Unfortunately, this is also the driest and least well written of the four If you are looking for a book Asset Allocation: Balancing Financial Risk: 3rd (Third) edition by Roger Gibson Roger C. Gibson in pdf format, in that case you come on to the correct website..

I have been thinking of this Graham suggestion a lot [and after reading about 100 books on investing in the past 4 years, including Bernstein, Ferri, Ellis, Swensen, Malkiel, and Roger Gibson on asset allocation]. Roger Gibson is perhaps best known as the author of the investment classic Asset Allocation: Balancing Financial Risk. While the concept and theory of asset allocation were not new, Roger's book was the first written on the subject. The book bridges the gap between modern portfolio theory and the real-life investment decisions that clients and their advisors must make. Praised by the financial

If you are looking for a book Asset Allocation: Balancing Financial Risk: 3rd (Third) edition by Roger Gibson Roger C. Gibson in pdf format, in that case you come on to the correct website. The definitive guidebook for successful long-term investing. The third edition of Roger C. Gibson's Asset Allocation: Balancing Financial Risk was released in 2000 on the heels of the biggest bull market in a century and amidst talk of a new economy.

In order to demonstrate the power of diversification Roger Gibson shows the returns and standard deviation of an equity portfolio of 25% domestic stocks (using total stock market), 25% international stocks (using MSCI EAFE), 25% real estate (REIT), and 25% commodities futures. If searched for a ebook by Roger C. Gibson Asset Allocation: Balancing Financial Risk in pdf format, in that case you come on to the correct website.

13 Asset Allocation for Volatile Markets Roger C. Gibson, CFA, CFP® Suite 2200, 6600 Brooktree Court, Wexford, PA 15090 724.934.3200 www.gibsoncapital.com 2015 GIbson Capital, LLC 5 “Frame-of-Reference” Risk Source: 2004 Roger C. Gibson Asset Class Total Return W 29% X 16% Y 2% Z -15% Average 8%

12/05/2007 · Book Review: Asset Allocation by Roger Gibson The mere fact that this book is now in its 3rd edition indicates that to some degree it has stood the test of time. It is indeed a very good book, much of it brilliant, but it has some serious flaws and a 4th … Find great deals for Asset Allocation : Balancing Financial Risk by Roger C. Gibson (2013, Hardcover). Shop with confidence on eBay!

Asset Allocation, Roger Gibson, Business One Irwin (about $35). 3. Global Investing, Roger Ibbotson and Gary Brinson, McGraw Hill (about $40, also available through Ibbotson Associates). 4. Value Averaging, Michael Edelson, IPC ($22.95). If your time and resources are limited, you can "get by" with the Gibson book alone. Unfortunately, this is also the driest and least well written of the four Download ebook pdf Asset Allocation: Balancing Financial Risk - Roger C. Gibson Description: Dispensing with luck, market timing, and Buy low, sell high sleights of hand, this book aims to outline sensible decisions that all investors can make on their own. It include

If searched for a ebook by Roger C. Gibson Asset Allocation: Balancing Financial Risk in pdf format, in that case you come on to the correct website. 20/10/1989 · Gibson's Asset Allocation is a book written for readers interested in advance topics in investment or for potential financial investment managers. Readers with some statistical background may find the discussion of risk and time horizon very informative and …

"Roger Gibson's book should be a 'go-to' resource for every serious financial advisor." -- JOHN D. ROGERS, CFA, President and Chief Executive Officer, CFA Institute "The author balances a solid, Asset allocation involves dividing an investment port-folio among different asset categories, such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one. The asset allocation that works best for you at any given point in your life will depend largely on your time hori-zon and your ability to tolerate risk. Time Horizon Your

Gibson demonstrates how adding new asset classes to a portfolio improves its risk-adjusted returns and how strategic asset allocation uses, rather than fights, the forces of the capital markets to achieve fi … "Roger Gibson has revolutionized the way financial advisors assemble portfolios for their clients. He is, without a doubt, the best and most articulate voice on the subject of asset allocation today."

Asset Allocation: Balancing Financial Risk, Second Edition, is the revised edition of the best-selling reference book on asset allocation with completely updated facts and figures. Inside you'll find a comprehensive review of the capital market theory behind asset allocation, plus step-by-step guidelines for designing and implementing 2015 GIbson Capital, LLC 5 “Frame-of-Reference” Risk Source: 2004 Roger C. Gibson Asset Class Total Return W 29% X 16% Y 2% Z -15% Average 8%

And yet, Roger C. Gibson’s fine and exemplary book, Asset Allocation: Balancing Financial Risk , Fourth Edition, shows that character and conscience-based … 3 Gibson, R., 2008 (4th Edition), “Asset Allocation, Balancing Financial Risk”, p13 4 This paper does not intend to debate the efficient market hypothesis (EMH). Roger Gibson’s “Asset Allocation,