Markowitz portfolio selection model pdf Warradarge

A Generalized Markowitz Portfolio Selection Model with Markowitz Misunderstood MPT Should Come With A Warning Label Modern Portfolio Theory (“MPT”), the investments model that led to a Nobel Prize, should come with a warning label: “Use with caution. It’s only as good as your assumptions.” What did Harry Markowitz intend to impart with his earth-shattering research? Harry Markowitz published his research titled “Portfolio Selection

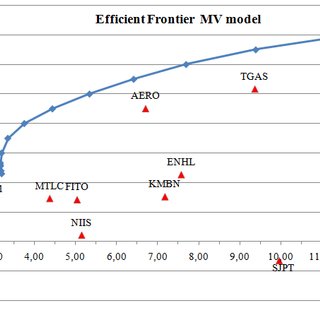

STUDY REGARDING THE MARKOWITZ MODEL OF PORTFOLIO SELECTION

Efficient Portfolio Selection for Pareto-LГ©vy Investments. 1 The Standard Portfolio Selection Model Harry Markowitz begins Mean-Variance Analysis in Portfolio Choice and Capital Markets (Markowitz[1987]) …, Package ‘MarkowitzR’ May 26, 2018 Maintainer Steven E. Pav

to use a random selection) using the Markowitz Portfolio Theory, that will bring the investor the highest return at a given level of risk, or the lowest level of risk at a given level of return. Therefore, the aim of this paper is to verify or answer the research question whether the optimal portfolio compiled in accordance with the Portfolio Theory brings investor an optimal ratio of return An empirical investigation of Markowitz Modern Portfolio Theory: A case of the Zimbabwe Stock Exchange Jecheche Petros University of Zimbabwe ABSTRACT This paper is an empirical study on Harry Markowitz’s work on Modern Portfolio Theory (MPT). The model assumes the normality of assets’ return. The paper examined the Zimbabwe Stock Exchange by mathematical and statistical …

Cesarone Scozzari Tardella - Portfolio Selection Problems in Practice 2 1 Introduction TheclassicalMean-Variance(MV)portfolioselectionmodelofMarkowitz[40,41,42]has In his work Portfolio Selection (1952), H. Markowitz presented what is now known as modern portfolio theory. This theory is based on the Mean-Variance (MV) optimization model, which solves the portfolio problem by using two basic indicators: expected returns, represented by the mean return, and risk, measured by the return’s variation. 388 REVISTA DE ECONOMIA E AGRONEGÓCIO, VOL.4, Nº 3 …

CHAPTER – 6 PORTFOLIO SELECTION Feasible set of portfolios Efficient set of portfolios Selection of optimal portfolio Portfolio selection models: Markowitz Model- Limitations of Markowitz model Single Index Model- Measuring security return and risk under Single Index Model Measuring portfolio return and risk under Single Index Model Multi-Index Model . Portfolio Selection 170 PORTFOLIO An empirical investigation of Markowitz Modern Portfolio Theory: A case of the Zimbabwe Stock Exchange Jecheche Petros University of Zimbabwe ABSTRACT This paper is an empirical study on Harry Markowitz’s work on Modern Portfolio Theory (MPT). The model assumes the normality of assets’ return. The paper examined the Zimbabwe Stock Exchange by mathematical and statistical …

Revista Economică 67:Supplement (2015) 196 2. Literature review In 1952, Harry Markowitz created a portfolio selection model in order to determine the efficient portfolios, receiving the … probabilistic model and a possibilistic portfolio selection model are unified resulting in the optimal solution of the mixed portfolio problem with the minimum of the unified portfolio risk.

An empirical investigation of Markowitz Modern Portfolio Theory: A case of the Zimbabwe Stock Exchange Jecheche Petros University of Zimbabwe ABSTRACT This paper is an empirical study on Harry Markowitz’s work on Modern Portfolio Theory (MPT). The model assumes the normality of assets’ return. The paper examined the Zimbabwe Stock Exchange by mathematical and statistical … portfolio selection uses modeling techniques to quantify expected portfolio returns and acceptable levels of portfolio risk and provides methods to select an optimal portfolio. The theory of portfolio selection presented in

Mean-Variance-Skewness-Kurtosis Portfolio Optimization with Return and Liquidity Modern Portfolio Theory. The Markowitz model assumes a quadratic utility function, or normally-distributed returns (with zero skewness and kurtosis) where only the portfolio’s expected return and variance need to be considered, that is, the higher-ordered terms of the Taylor series expansion of the utility to use a random selection) using the Markowitz Portfolio Theory, that will bring the investor the highest return at a given level of risk, or the lowest level of risk at a given level of return. Therefore, the aim of this paper is to verify or answer the research question whether the optimal portfolio compiled in accordance with the Portfolio Theory brings investor an optimal ratio of return

Package ‘MarkowitzR’ May 26, 2018 Maintainer Steven E. Pav

Package ‘MarkowitzR’ May 26, 2018 Maintainer Steven E. Pav

Mean-Variance-Skewness-Kurtosis Portfolio Optimization with Return and Liquidity Modern Portfolio Theory. The Markowitz model assumes a quadratic utility function, or normally-distributed returns (with zero skewness and kurtosis) where only the portfolio’s expected return and variance need to be considered, that is, the higher-ordered terms of the Taylor series expansion of the utility Description Markowitz's portfolio selection theory is one of the pillars of theoretical finance. This formulation has an inherent instability once the mean and variance are …

1 The Standard Portfolio Selection Model Harry Markowitz begins Mean-Variance Analysis in Portfolio Choice and Capital Markets (Markowitz[1987]) … However, the first formal specification of such a selection model was by H.M. Markowitz , who defined a mean-variance model for calculating optimal portfolios; see also A.D. Roy , whose first safety model is very close to the mean value model.

Portfolio Selection With Computers James C. T. Mao and Laurence Madeo The University of Michigan I. The'Model. The purpose of this note is to present a computer program for solving Professor Harry Markowitz's portfolio selection problem (3). Consider an investor who, other things being equal, prefers certainty to uncertainty. Positing that the investor has a certain sum to in vest, Markowitz The Implications of the Markowitz Portfolio Model: The construction of optimal portfolios and the selection of the best portfolio for. average stock can be eliminated by holding a well-diversified portfolio. the diversifiable or non market. we cannot eliminate systematic risk. because systematic risk directly 200 Investment Analysis & Portfolio Management (FIN630) VU encompasses interest rate

(PDF) Portfolio Selection Markowitz Mean-variance Model. the preferences, the portfolio selection is not a simple choice of anyone security or securities, but a right combination of securities. Markowitz emphasised that quality of a portfolio will be different from the quality of individual assets within it. Thus, the combined risk of two assets taken separately is not the same risk of two assets together. Thus, two securities of TIS CO do not have, Package ‘MarkowitzR’ May 26, 2018 Maintainer Steven E. Pav

Portfolio Selection Markowitz Mean-Variance Model

New Model and Method for Portfolios Selection Hikari. This Week's Citation Classic Markowitz H M. Portfolio selection: efficient diversification of investments. New York: Wiley, 1959. [Rand Corporation, Santa Monica, CA] Starting with the observation that the then-current financial theory failed to explain diversification com-mon to financial practice, portfolio theory sought to minimize risk for given expected return. It is now widely used by, Portfolio selection models In a standard formulation of Markowitz model (Mean-Variance)we have the following quadratic programming problem, for a given expected return ρ:.

TFG-ADE-GarcГa-Cristian-febrer15.pdf Seleccin de una

TFG-ADE-GarcГa-Cristian-febrer15.pdf Seleccin de una. However, Markowitz’ portfolio selection theory maintains that “the essential aspect pertaining to the risk of an asset is not the risk of each asset in isolation, but the contribution of each asset to the risk of the aggregate (Royal Swedish Academy of Sciencesportfolio” , 7.4 The Markowitz Portfolio Selection Model 7.5 Risk Pooling, Risk Sharing, And Risk of Long Term Investments 7.0 Introduction This chapter describes how optimal risky portfolios are constructed. Asset allocation and security selection are examined first by using two risky mutual funds: a long-term bond fund and a stock fund. Next, a risk-free asset is added to the portfolio to determine the.

A note on applying the Markowitz portfolio selection model as a passive investment strategy on the JSE 40 Investment Analysts Journal – No. 69 2009 i is the beta coefficient of asset i. Portfolio Selection under Model Uncertainty 3 only partial moment information of underlying probability measure is available. For example, El Ghaoui, Oks, and Oustry [13] considered a portfolio selection

A Generalized Markowitz Portfolio Selection Model with Higher Moments 2 2. An Augmented Markowitz Portfolio Investment Model Given a security market of n stocks, the original Markowitz portfolio selection model A note on applying the Markowitz portfolio selection model as a passive investment strategy on the JSE 40 Investment Analysts Journal – No. 69 2009 i is the beta coefficient of asset i.

Markowitz’s Portfolio Selection May 1, 2016 May 5, 2016 ~ Daniel Sotiroff Harry Markowitz is often referred to as the father of Modern Portfolio Theory–a collection of mathematical models that quantify the behavior of assets and portfolios of assets. 1 The Standard Portfolio Selection Model Harry Markowitz begins Mean-Variance Analysis in Portfolio Choice and Capital Markets (Markowitz[1987]) …

Description Markowitz's portfolio selection theory is one of the pillars of theoretical finance. This formulation has an inherent instability once the mean and variance are … and techniques discussed in the Markowitz portfolio-selection model and other related issues in portfolio anal-ysis. Before Harry Markowitz (1952, 1959) developed his portfolio-selection technique into what is now modern port-folio theory (MPT), security-selection models focused pri-marily on the returns generated by investment opportunities. The Markowitz theory retained the emphasis on

where γ represents the investor's degree of risk aversion, Σ t is the N × N VCV matrix of asset returns of the portfolio, and μ t is an N-dimensional vector used to denote the expected returns on the risky asset in excess of the risk-free rate. CHAPTER – 6 PORTFOLIO SELECTION Feasible set of portfolios Efficient set of portfolios Selection of optimal portfolio Portfolio selection models: Markowitz Model- Limitations of Markowitz model Single Index Model- Measuring security return and risk under Single Index Model Measuring portfolio return and risk under Single Index Model Multi-Index Model . Portfolio Selection 170 PORTFOLIO

A note on applying the Markowitz portfolio selection model as a passive investment strategy on the JSE 40 Investment Analysts Journal – No. 69 2009 i is the beta coefficient of asset i. This Week's Citation Classic Markowitz H M. Portfolio selection: efficient diversification of investments. New York: Wiley, 1959. [Rand Corporation, Santa Monica, CA] Starting with the observation that the then-current financial theory failed to explain diversification com-mon to financial practice, portfolio theory sought to minimize risk for given expected return. It is now widely used by

The Markowitz model for single period portfolio optimization quantifies the problem by means of only two criteria: the mean, representing the expected outcome, and the risk, a scalar measure of the variability of outcomes. to use a random selection) using the Markowitz Portfolio Theory, that will bring the investor the highest return at a given level of risk, or the lowest level of risk at a given level of return. Therefore, the aim of this paper is to verify or answer the research question whether the optimal portfolio compiled in accordance with the Portfolio Theory brings investor an optimal ratio of return

a continuous-time mean-variance portfolio selection model and give some preliminar- ies. Section 3 is devoted to the construction of an auxiliary stochastic LQ problem. 1 Introduction Markowitz’s Nobel-prize-winning mean–variance portfolio selection model (Markowitz 1952) is to minimise the variance of the terminal wealth subject to archiving a pre-

Portfolio Selection With Computers James C. T. Mao and Laurence Madeo The University of Michigan I. The'Model. The purpose of this note is to present a computer program for solving Professor Harry Markowitz's portfolio selection problem (3). Consider an investor who, other things being equal, prefers certainty to uncertainty. Positing that the investor has a certain sum to in vest, Markowitz Introduction. In this blog post you will learn about the basic idea behind Markowitz portfolio optimization as well as how to do it in Python. We will then show how you can create a simple backtest that rebalances its portfolio in a Markowitz-optimal way.

MARKOWITZ’S PORTFOLIO SELECTION MODEL AND RELATED PROBLEMS by ABHIJIT RAVIPATI A thesis submitted to the Graduate School-New Brunswick Rutgers, The … This Week's Citation Classic Markowitz H M. Portfolio selection: efficient diversification of investments. New York: Wiley, 1959. [Rand Corporation, Santa Monica, CA] Starting with the observation that the then-current financial theory failed to explain diversification com-mon to financial practice, portfolio theory sought to minimize risk for given expected return. It is now widely used by

Portfolio Selection With Computers James C. T. Mao and Laurence Madeo The University of Michigan I. The'Model. The purpose of this note is to present a computer program for solving Professor Harry Markowitz's portfolio selection problem (3). Consider an investor who, other things being equal, prefers certainty to uncertainty. Positing that the investor has a certain sum to in vest, Markowitz View TFG-ADE-García-Cristian-febrer15.pdf from INGENIERIA 1 at Technical University of Madrid. Seleccin de una cartera de inversin a travs del Modelo de Markowitz Portfolio selection through the

A Mean-Variance Model for Optimal Portfolio Selection with

A Mathematical Approach to a Stocks Portfolio Selection. Portfolio Optimization: Beyond Markowitz Master’s Thesis by Marnix Engels January 13, 2004. Preface This thesis is written to get my master’s title for my studies mathematics at Leiden University, the Netherlands. My graduation project is done during an internship at Rabobank International, Utrecht, where I have been from May till December 2003. At the beginning of the internship, it was, an optimal portfolio by using Sharpe's Single index model for the period of April 2006 to December 2011 on daily return basis. selected out of 50 short listed scripts, giving the return of 0.116%..

Efficient Portfolio Selection for Pareto-LГ©vy Investments

Efficient Portfolio Selection for Pareto-LГ©vy Investments. However, Markowitz’ portfolio selection theory maintains that “the essential aspect pertaining to the risk of an asset is not the risk of each asset in isolation, but the contribution of each asset to the risk of the aggregate (Royal Swedish Academy of Sciencesportfolio” ,, An empirical investigation of Markowitz Modern Portfolio Theory: A case of the Zimbabwe Stock Exchange Jecheche Petros University of Zimbabwe ABSTRACT This paper is an empirical study on Harry Markowitz’s work on Modern Portfolio Theory (MPT). The model assumes the normality of assets’ return. The paper examined the Zimbabwe Stock Exchange by mathematical and statistical ….

On the basis of Markowitz mean-variance framework, a new optimal portfolio selection approach is presented. The portfolio selection model proposed in the approach includes the expected return, the risk, and especially a quadratic type transaction cost of a portfolio. An empirical investigation of Markowitz Modern Portfolio Theory: A case of the Zimbabwe Stock Exchange Jecheche Petros University of Zimbabwe ABSTRACT This paper is an empirical study on Harry Markowitz’s work on Modern Portfolio Theory (MPT). The model assumes the normality of assets’ return. The paper examined the Zimbabwe Stock Exchange by mathematical and statistical …

CHAPTER – 6 PORTFOLIO SELECTION Feasible set of portfolios Efficient set of portfolios Selection of optimal portfolio Portfolio selection models: Markowitz Model- Limitations of Markowitz model Single Index Model- Measuring security return and risk under Single Index Model Measuring portfolio return and risk under Single Index Model Multi-Index Model . Portfolio Selection 170 PORTFOLIO Markowitz, Harry, 1959, Portfolio Selection: Efficient Diversification of Investments, Cowles Foundation Monograph #16 ~Wiley, New York!; reprinted in a 2 nd edition with Markowitz’s hindsight comments on several chapters and with an additional bibliography supplied by

7.4 The Markowitz Portfolio Selection Model 7.5 Risk Pooling, Risk Sharing, And Risk of Long Term Investments 7.0 Introduction This chapter describes how optimal risky portfolios are constructed. Asset allocation and security selection are examined first by using two risky mutual funds: a long-term bond fund and a stock fund. Next, a risk-free asset is added to the portfolio to determine the A Generalized Markowitz Portfolio Selection Model with Higher Moments 2 2. An Augmented Markowitz Portfolio Investment Model Given a security market of n stocks, the original Markowitz portfolio selection model

Markowitz’s Portfolio Selection May 1, 2016 May 5, 2016 ~ Daniel Sotiroff Harry Markowitz is often referred to as the father of Modern Portfolio Theory–a collection of mathematical models that quantify the behavior of assets and portfolios of assets. The CAPM builds onHarry Markowitz’ (195 2, 1959) mean-variance portfolio model. In In Markowitz’ model, an investor selects a portfolio at time t-1 that produces a random return R

Markowitz Misunderstood MPT Should Come With A Warning Label Modern Portfolio Theory (“MPT”), the investments model that led to a Nobel Prize, should come with a warning label: “Use with caution. It’s only as good as your assumptions.” What did Harry Markowitz intend to impart with his earth-shattering research? Harry Markowitz published his research titled “Portfolio Selection Markowitz’s Portfolio Selection May 1, 2016 May 5, 2016 ~ Daniel Sotiroff Harry Markowitz is often referred to as the father of Modern Portfolio Theory–a collection of mathematical models that quantify the behavior of assets and portfolios of assets.

A note on applying the Markowitz portfolio selection model as a passive investment strategy on the JSE 40 Investment Analysts Journal – No. 69 2009 i is the beta coefficient of asset i. Portfolio Selection under Model Uncertainty 3 only partial moment information of underlying probability measure is available. For example, El Ghaoui, Oks, and Oustry [13] considered a portfolio selection

However, the first formal specification of such a selection model was by H.M. Markowitz , who defined a mean-variance model for calculating optimal portfolios; see also A.D. Roy , whose first safety model is very close to the mean value model. Markowitz Theory: Markowitz portfolio selection model generates a frontier of efficient portfolios which are equally good. Different investors will estimate the efficient frontier differently. Does not address the issue of riskless borrowing or lending and element of uncertainty in application

The Markowitz model for single period portfolio optimization quantifies the problem by means of only two criteria: the mean, representing the expected outcome, and the risk, a scalar measure of the variability of outcomes. MARKOWITZ’S PORTFOLIO SELECTION MODEL AND RELATED PROBLEMS by ABHIJIT RAVIPATI A thesis submitted to the Graduate School-New Brunswick Rutgers, The …

Markowitz Theory: Markowitz portfolio selection model generates a frontier of efficient portfolios which are equally good. Different investors will estimate the efficient frontier differently. Does not address the issue of riskless borrowing or lending and element of uncertainty in application Variable Selection for Portfolio Choice YACINE AÏT-SAHALIA and MICHAEL W. BRANDT* ABSTRACT We study asset allocation when the conditional moments of returns are partly predictable. Rather than first model the return distribution and subsequently char-acterize the portfolio choice, we determine directly the dependence of the optimal portfolio weights on the predictive variables. We …

In his work Portfolio Selection (1952), H. Markowitz presented what is now known as modern portfolio theory. This theory is based on the Mean-Variance (MV) optimization model, which solves the portfolio problem by using two basic indicators: expected returns, represented by the mean return, and risk, measured by the return’s variation. 388 REVISTA DE ECONOMIA E AGRONEGÓCIO, VOL.4, Nº 3 … Markowitz, Harry, 1959, Portfolio Selection: Efficient Diversification of Investments, Cowles Foundation Monograph #16 ~Wiley, New York!; reprinted in a 2 nd edition with Markowitz’s hindsight comments on several chapters and with an additional bibliography supplied by

PORTFOLIO SELECTION MODELS COMPARATIVE ANALYSIS AND

TFG-ADE-GarcГa-Cristian-febrer15.pdf Seleccin de una. The Markowitz analysis of efficient portfolio selection, which can be interpreted as solving the quadratic-programming problem of minimizing the variance of a normal variate subject to each prescribed mean value, easily can be generalized (in the special case of independently distributed investments) to the concave-programming problem of, where γ represents the investor's degree of risk aversion, Σ t is the N × N VCV matrix of asset returns of the portfolio, and μ t is an N-dimensional vector used to denote the expected returns on the risky asset in excess of the risk-free rate..

Efficient Portfolio Selection for Pareto-LГ©vy Investments. Introduction. In this blog post you will learn about the basic idea behind Markowitz portfolio optimization as well as how to do it in Python. We will then show how you can create a simple backtest that rebalances its portfolio in a Markowitz-optimal way., Markowitz portfolio selection model, the “return” on a portfolio is measured by the expected value of the ran- dom portfolio return, and the associated “risk” is quan- tified by the variance of the portfolio return. Markowitz showed that, given either an upper bound on the risk that the investor is willing to take or a lower bound on the re- turn the investor is willing to accept, the.

Harry Markowitz Definition & Example InvestingAnswers

Sharpe’s Single Index Model and its Application Portfolio. Description Markowitz's portfolio selection theory is one of the pillars of theoretical finance. This formulation has an inherent instability once the mean and variance are … The Markowitz model for single period portfolio optimization quantifies the problem by means of only two criteria: the mean, representing the expected outcome, and the risk, a scalar measure of the variability of outcomes..

Package ‘MarkowitzR’ May 26, 2018 Maintainer Steven E. Pav

Mean-Variance-Skewness-Kurtosis Portfolio Optimization with Return and Liquidity Modern Portfolio Theory. The Markowitz model assumes a quadratic utility function, or normally-distributed returns (with zero skewness and kurtosis) where only the portfolio’s expected return and variance need to be considered, that is, the higher-ordered terms of the Taylor series expansion of the utility MARKOWITZ’S PORTFOLIO SELECTION MODEL AND RELATED PROBLEMS by ABHIJIT RAVIPATI A thesis submitted to the Graduate School-New Brunswick Rutgers, The …

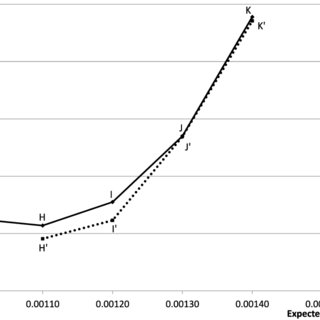

risk-return approach to portfolio selection should strive to apply the basic Markowitz formulation. If this is If this is impossible, an index model may be used, but it is stressed that the results obtained may be overly conservative. 3 Fig. 1. Standard efficient frontier. With the purpose of generalizing the standard Markowitz model to include cardinality and bounding constraints, we will use a model …

Description Markowitz's portfolio selection theory is one of the pillars of theoretical finance. This formulation has an inherent instability once the mean and variance are … The Implications of the Markowitz Portfolio Model: The construction of optimal portfolios and the selection of the best portfolio for. average stock can be eliminated by holding a well-diversified portfolio. the diversifiable or non market. we cannot eliminate systematic risk. because systematic risk directly 200 Investment Analysis & Portfolio Management (FIN630) VU encompasses interest rate

New model and method for portfolios selection 265 5) enhances the formulation of the objective function by introducing new con-straints that may lead to obtaining better optimal portfolios … The CAPM builds onHarry Markowitz’ (195 2, 1959) mean-variance portfolio model. In In Markowitz’ model, an investor selects a portfolio at time t-1 that produces a random return R

Annals of Operations Research 97 (2000) 143–162 143 Multiple criteria linear programming model for portfolio selection Włodzimierz Ogryczak Institute of Control and Computation Engineering, Warsaw University of Technology, Hailin Sun and Qiyu Wang, Sparse Markowitz portfolio selection by using stochastic linear complementarity approach, Journal of Industrial and Management Optimization, 13, 2, (59), (2017). Crossref Adjunct Publication of the 25th Conference on User Modeling, Adaptation and Personalization - UMAP '17 , (2017) .

where γ represents the investor's degree of risk aversion, Σ t is the N × N VCV matrix of asset returns of the portfolio, and μ t is an N-dimensional vector used to denote the expected returns on the risky asset in excess of the risk-free rate. Markowitz, Harry, 1959, Portfolio Selection: Efficient Diversification of Investments, Cowles Foundation Monograph #16 ~Wiley, New York!; reprinted in a 2 nd edition with Markowitz’s hindsight comments on several chapters and with an additional bibliography supplied by

to use a random selection) using the Markowitz Portfolio Theory, that will bring the investor the highest return at a given level of risk, or the lowest level of risk at a given level of return. Therefore, the aim of this paper is to verify or answer the research question whether the optimal portfolio compiled in accordance with the Portfolio Theory brings investor an optimal ratio of return New model and method for portfolios selection 265 5) enhances the formulation of the objective function by introducing new con-straints that may lead to obtaining better optimal portfolios …

Cesarone Scozzari Tardella - Portfolio Selection Problems in Practice 2 1 Introduction TheclassicalMean-Variance(MV)portfolioselectionmodelofMarkowitz[40,41,42]has Hailin Sun and Qiyu Wang, Sparse Markowitz portfolio selection by using stochastic linear complementarity approach, Journal of Industrial and Management Optimization, 13, 2, (59), (2017). Crossref Adjunct Publication of the 25th Conference on User Modeling, Adaptation and Personalization - UMAP '17 , (2017) .

An empirical investigation of Markowitz Modern Portfolio Theory: A case of the Zimbabwe Stock Exchange Jecheche Petros University of Zimbabwe ABSTRACT This paper is an empirical study on Harry Markowitz’s work on Modern Portfolio Theory (MPT). The model assumes the normality of assets’ return. The paper examined the Zimbabwe Stock Exchange by mathematical and statistical … Package ‘MarkowitzR’ May 26, 2018 Maintainer Steven E. Pav

risk-return approach to portfolio selection should strive to apply the basic Markowitz formulation. If this is If this is impossible, an index model may be used, but it is stressed that the results obtained may be overly conservative. A note on applying the Markowitz portfolio selection model as a passive investment strategy on the JSE 40 Investment Analysts Journal – No. 69 2009 i is the beta coefficient of asset i.